Vendor Refund

Overview

Record a refund that the supplier or vendor has paid back to you.

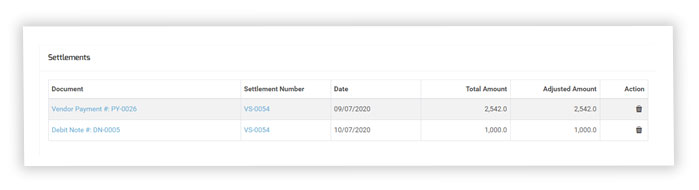

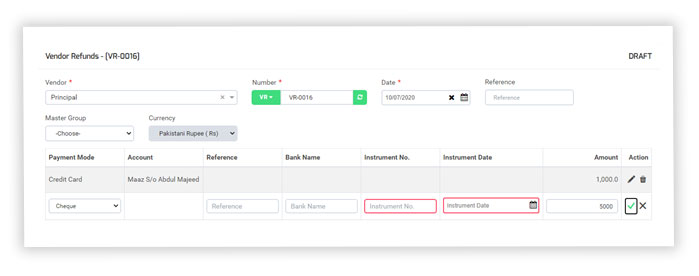

Create Vendor Refund

- In the left navigation menu select Vendor refund.

- Click “+Add Vendor Refund” to add new refunds.

- Complete the vendor refund form.

- Click “Save and Continue Edit” to save the Refund as a draft, or click “Save and Approve” to approve or click “Save and Pending” to mark the Refund as pending and enter a new Refund or click “Save and New” to record a new Refund and save the previous one or click “Save and Close” to close the Refund and save the refund in draft status.

Vendor refund field and their description

- Vendor: Enter the name of the supplier you would like to get a refund. If you enter a name that’s not already a contact, Splendid Account adds it to your Vendor contacts.

- Date: This will default to today’s date. You can change this also.

- Vendor refund number: Use the Splendid Accounts default numbering sequence or you can add your customized number sequence.

- Reference: Choose a reference to suit your company or your supplier. Later, you may want to search for your purchase return using your chosen reference.

- Group: This field appears only if you have set up Groups. Groups let you customize the differentiate of your vendor payment from different groups.

- Currency: If you have a Business Edition plan with multi-currency, you can select a foreign currency vendor that you’ve already added, you can edit the exchange rate if required.

If you entered a default currency vendor, it automatically displays.

Vendor Refund line fields

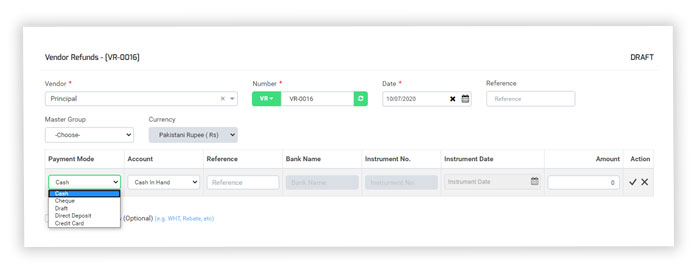

- Click on the payment mode searching box to add your payment mode to pay.

- Click the Right icon to save the line item, or click the Cancel icon beside the line item to save or cancel the line item.

- Use the Tab key on your keyboard to move between the lines.

Vendor Refund line field and description

- Payment mode: Select the payment by which mode your vendor has to pay you.

Different payment modes could be selected against single payable.

- Accounts: Must be mandatory to select your accounts against payment mode from which account you would need to your vendor.

- Instrument no and Instrument date: Entered the instrument number, instrument date for record of your account.

Must be mandatory to enter the instrument number, instrument date against Cheque, Draft, and Direct Deposit payments.

- Detail Group A: This field appears only if you have enabled Groups. Groups let you customize the differentiation of your vendor refund in many ways.

- Detail Group B: This field appears only if you have enabled Groups. Groups let you customize the differentiation of your vendor refund in many ways.

- Amount: Enter the refund amount your vendor has to pay you against the payable invoices.

Either Pay full amount or partial amount settled accordingly. - Account adjustment: Splendid Accounts has an account adjustment (optional) field in a vendor refund screen to adjust your bills or enter the Tax rebate expenses in the Total bill.

Or extra expenses like Add shipping charges of your good received or services that your vendor has paid to you.

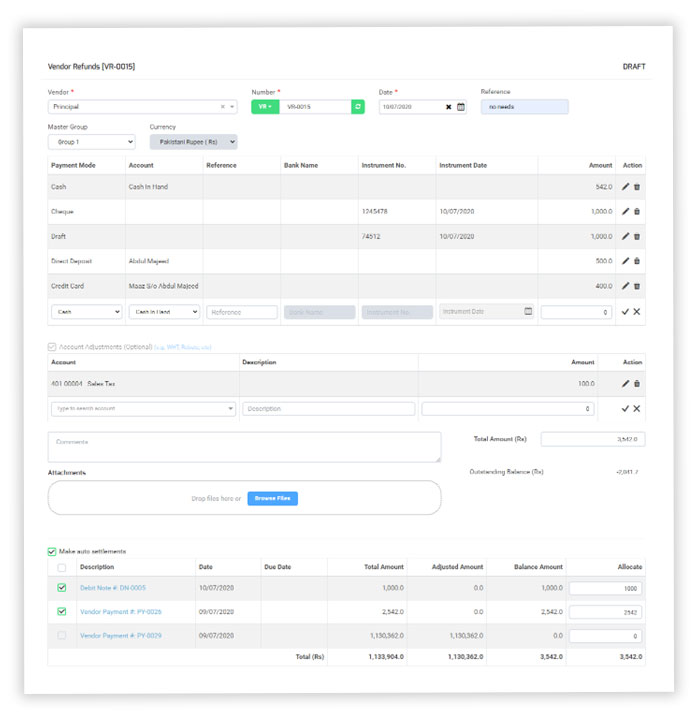

Settlements

-

- In Splendid Accounts, you have to option settle your payable bills in form refund that vendor pays back to you.

- Also, you can settle your supplier or vendor’s Debit note.

- The default auto settlement of invoice and debit note has been settled against you returned amount entered.

- Also, you can settle your payables manually you want to settle against the refund amount entered.

- Also, you have seen your adjusted amount and Balance amount in settlements.